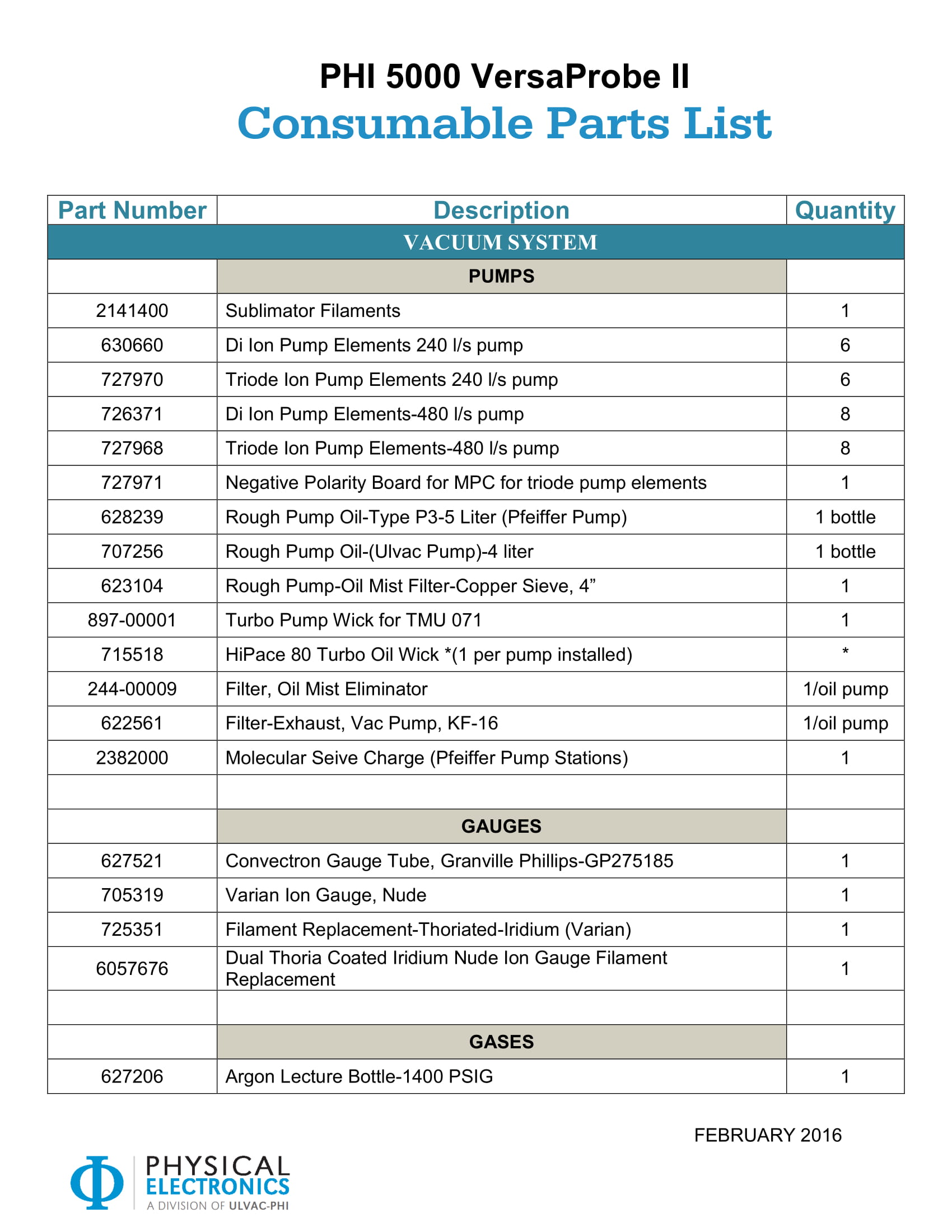

Examples of Consumables Format, Sample Examples

MATERIALITY: ACCOUNTING AND AUDITING. Materiality in financial reporting is addressed most completely in FASB Statement of Financial Accounting Concepts no. 2, Qualitative Characteristics of Accounting Information. It states, in part: "The essence of the materiality concept is clear. The omission or misstatement of an item in a financial.

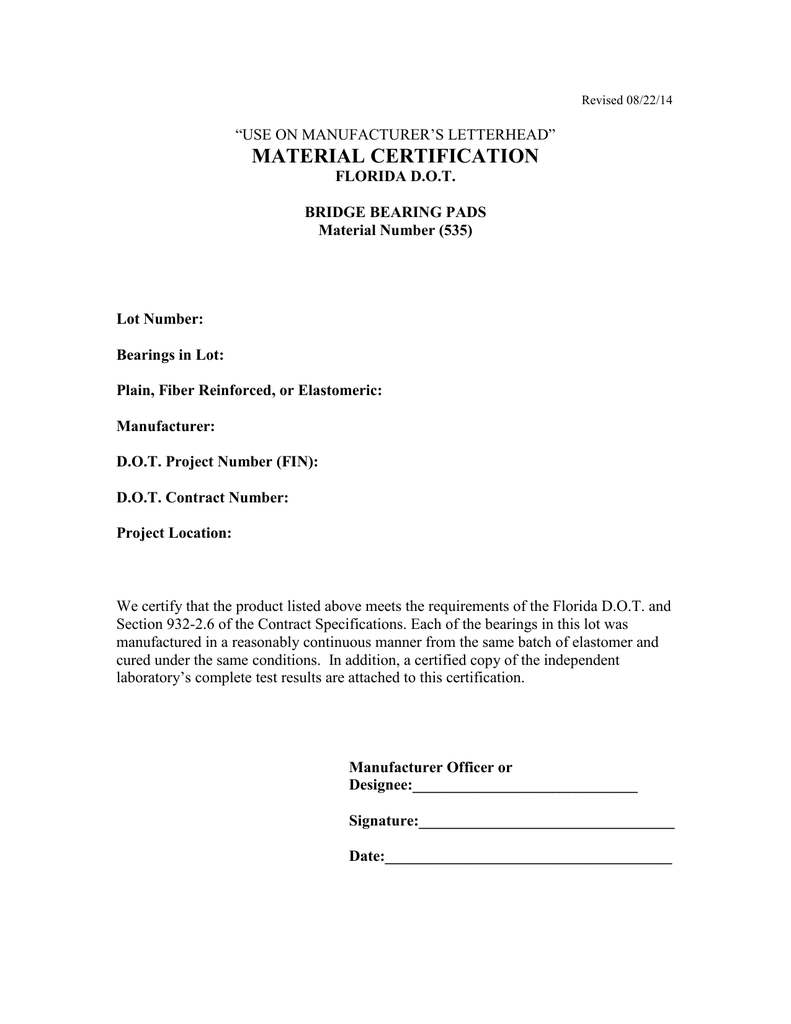

MATERIAL CERTIFICATION

A piece of information is considered material if its omission would affect a user's decision. Materiality is a concept used frequently by both internal accountants and auditors in determining the need to make adjustments for errors identified. Clearly, an item that is not deemed to be material is not relevant, as it would not affect a user's.

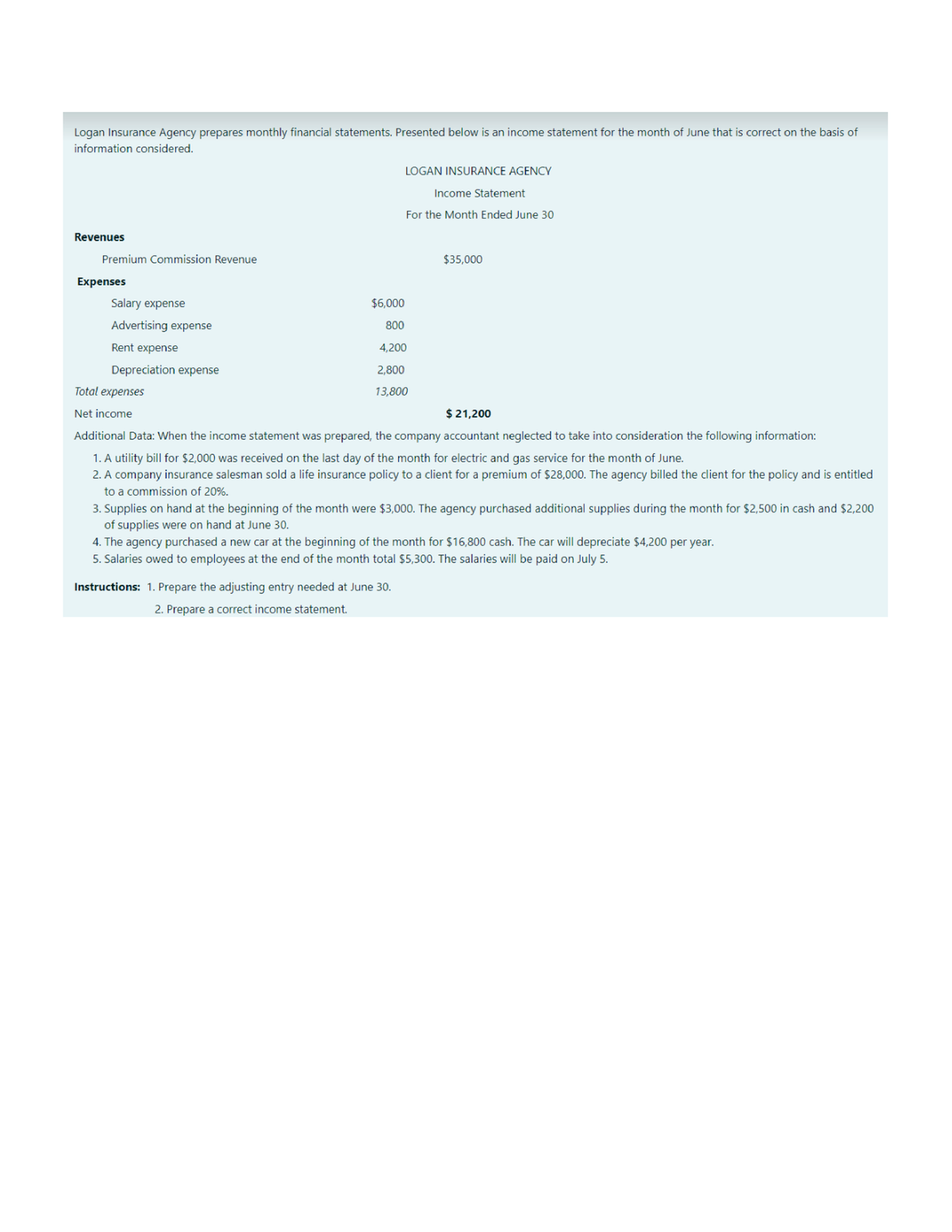

Assignment Chapter 3 An item is considered material if it would likely have changed or

The materiality definition in accounting refers to the relative size of an amount. Professional accountants determine materiality by deciding whether a value is material or immaterial in financial reports. Materiality is an essential understanding for accurate and ethical accounting, so its definition should be strongly considered.

PLEASE HELPP Select the correct answer. Which item is made from a synthetic material? cotton

Unacceptable items. Due to their weight and because they are not compostable, these items are not considered yard waste: Soil, sand or sod; Tree trunks and stumps over 50 pounds; Palm, yucca or ice plants; Chemically/pressure-treated woods; Rocks, stones, concrete or brick; For additional questions, click Request Help.

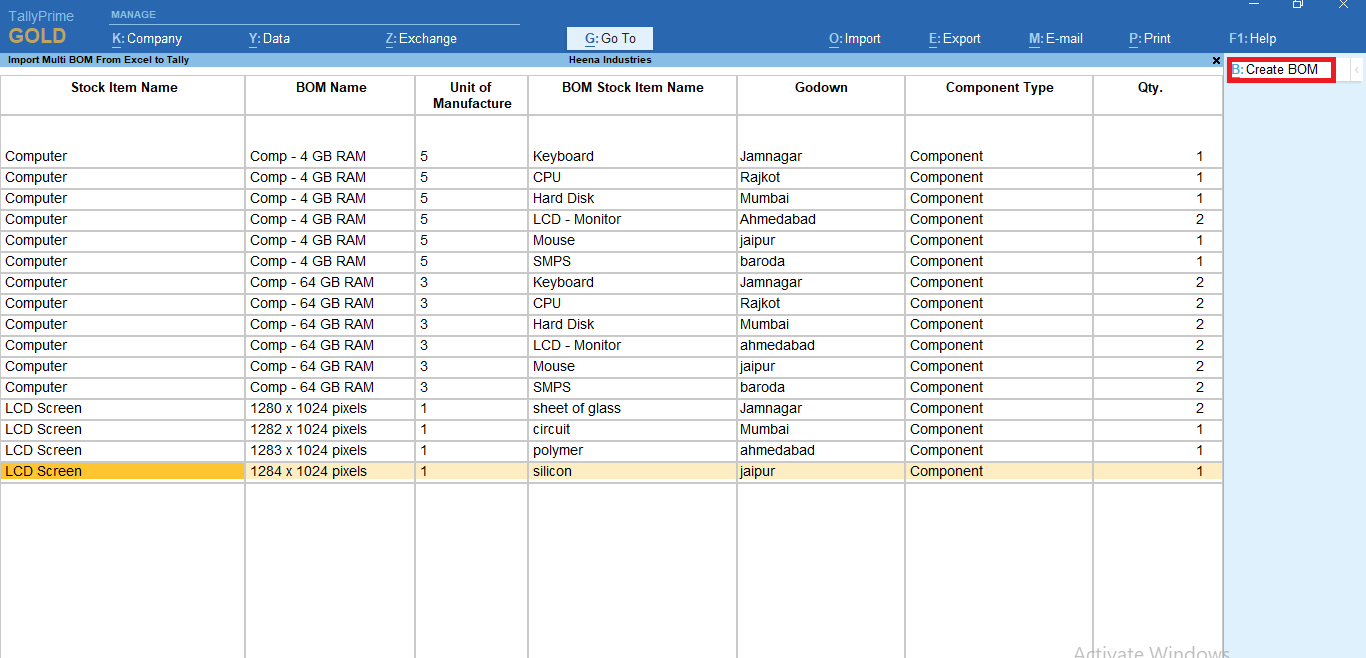

289 Import Bill of Material of Stock Item From Excel to tally

However, much smaller items may be considered material. For example, if a minor item would have changed a net profit to a net loss, then it could be considered material, no matter how small it might be. Similarly, a transaction would be considered material if its inclusion in the financial statements would change a ratio sufficiently to bring.

Household Hazardous Waste Collection Lucas County, OH Official Website

a. An item must make a difference or it need not be disclosed. b. Materiality is a matter of relative size or importance c. An item is material if the omission or mistatement would influence the judgement of a primary user. d. All of these statements are true about materiality., An item would be considered material when a.

:max_bytes(150000):strip_icc()/TermDefinitions_Inventory_finalv2-174a95eaeac3409d971256da7ecb164b.jpg)

What Is Inventory? Definition, Types, and Examples

An item is considered material if it is large enough to influence the decisions of users of the financial statements. Items that are not material are considered immaterial. Determining whether an item is material is a matter of professional judgment. There is no bright-line rule for determining materiality, and the judgment will vary depending.

Recycling Sustainability

An item is considered material if it affects the decision-making of the financial statement users. These users include the management, owners, and the general public. Usually, they are in large amounts. On the other hand, an item is considered immaterial if it does not affect the users' decision-making. Therefore, these items are not disclosed.

FREE 8+ Sample Material Lists in MS Word PDF

For example, instead of looking at whether a transaction of $1.00 or $1,000,000 is considered to be material, the auditor will refer to the percentage impact that the misstatement may have on the financial statements. So, for a company with $5 million in revenue, the $1 million misstatement can represent a 20% margin impact, which is very material.

Types of Insulation material in electrical 6 electrical YouTube

Correct answer is option " B: its size is likely to influence the decision of an investor o. An item is considered material if O it is of a tangible good. O its size is likely to influence the decision of an investor or creditor. O the cost of reporting the item is greater than its benefits. O it does not cost a lot of money.

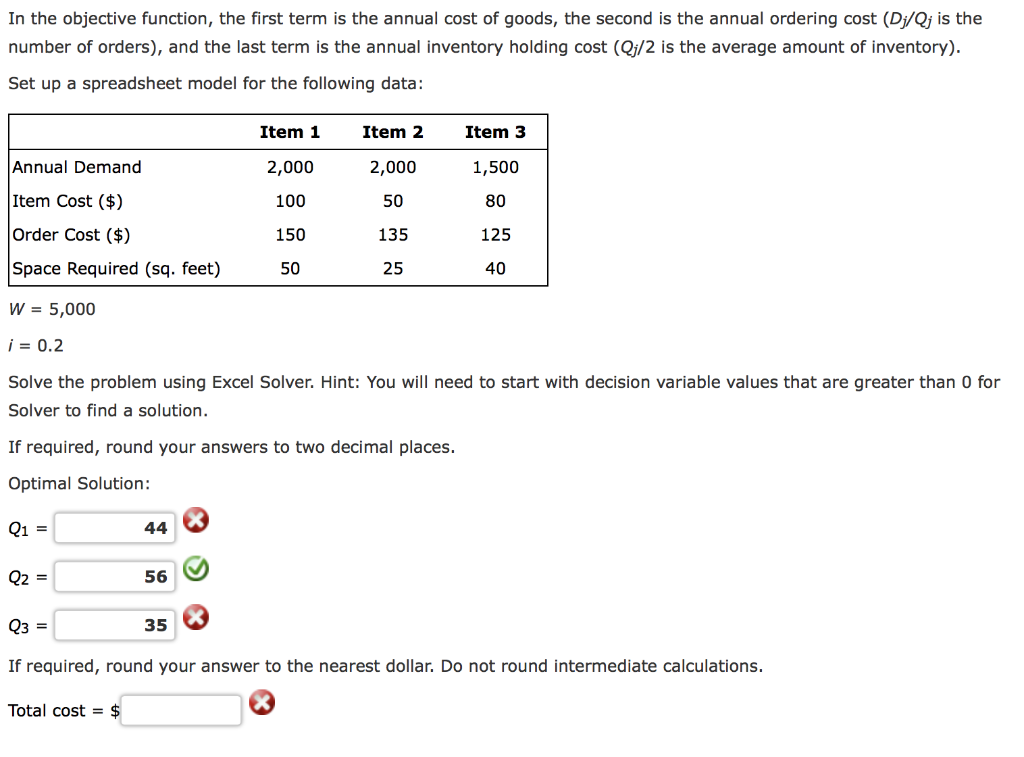

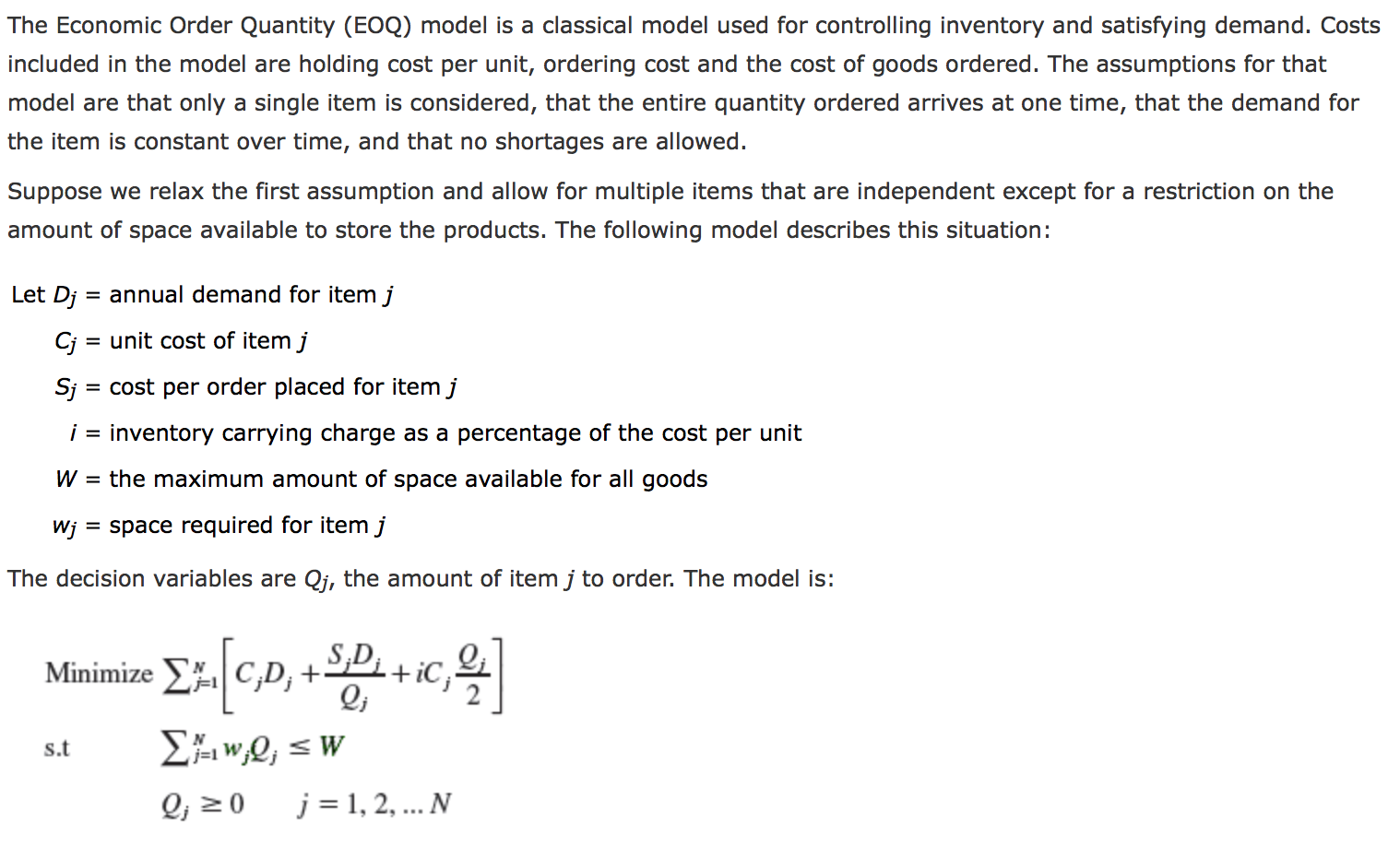

Solved The Economic Order Quantity (EOQ) model is a

What Is Materiality? Materiality is an accounting principle which states that all items that are reasonably likely to impact investors' decision-making must be recorded or reported in detail in a business's financial statements using GAAP standards. Essentially, materiality is related to the significance of information within a company's.

Solved The Economic Order Quantity (EOQ) model is a

Materiality is an.. An item is considered to be material if O the assets would be larger than the liabilities. O the information would change an investor's mind. O the company has a loss. O the company has never paid a dividend. Which of the following is a term that best describes the influence an item has on the decision of a reasonably.

WHAT IS ITEM ANALYSIS? YouTube

An item is considered material if it would likely have changed or influenced the decisions of a reasonable person using the statements. C. Materiality is easy to quantify. D. Reasonable assurance is a low level of assurance that the financial statements are free from material misstatement., (T/F) The audit objectives are the well-defined.

Elasticity Examples & Definition InvestingAnswers

The omission or misstatement of an item in a financial report is material if, in the light of surrounding circumstances, the magnitude of the item is such that it is probable that the judgment of a reasonable person relying upon the report would have been changed or influenced by the inclusion or correction of the item. 3

What Your Recyclables

Study with Quizlet and memorize flashcards containing terms like an item is considered material if A. it doesn't cost a lot of money B. it is of a tangible good C. its size is likely to influence the decision of an investor or creditor D. the cost of reporting the item is greater than its benefits, Garrison Company prepares quarterly reports, which it distributes to all stockholders and other.

EXCEL of Goods Receipt and Dispatch Inventory Summary Form.xlsx WPS Free Templates

Accounting questions and answers. An item is considered material if O its size is likely to influence the decision of an investor or creditor. O it does not cost a lot of money. O it is of a tangible good. O the cost of reporting the item is greater than its benefits.

- Audiolibro Las Bicicletas Son Para El Verano

- Do Emergency Row Seats Recline

- 5v 1a Adapter With Usb Port

- Convencion De Viena 1963 Resumen

- 10 Ft Galvanized Steel Corrugated Roof Panel Ontario

- Articulo 167 Del Codigo Penal

- Es Bueno Meter La Fruta En La Nevera

- Sensor De Nivel De Aceite Peugeot 206

- Cortinas Rústicas Para Casa Rurales

- Alumnos Con Taquicardia En Clase