How much rent can I afford? Rent Calculator Roost

How does the affordability calculator work? To calculate how much rent you can afford, we multiply your gross monthly income by 20%, 30% or 40%, based on how much you want to spend. You can use the slider to change the percentage of your income you want spend on housing. If you use the additional options, we deduct the rent from your income and.

How Much Rent Can You Afford? Gerber Moving and Storage, Kansas City

While there's no one-size-fits-all answer, most guidance is to spend no more than 30 percent of your income on rent. The actual amount of rent you can afford depends on your personal income and lifestyle. Consider your monthly income and factor in your various expenses such as groceries, gas, student loans, or medical bills to estimate what.

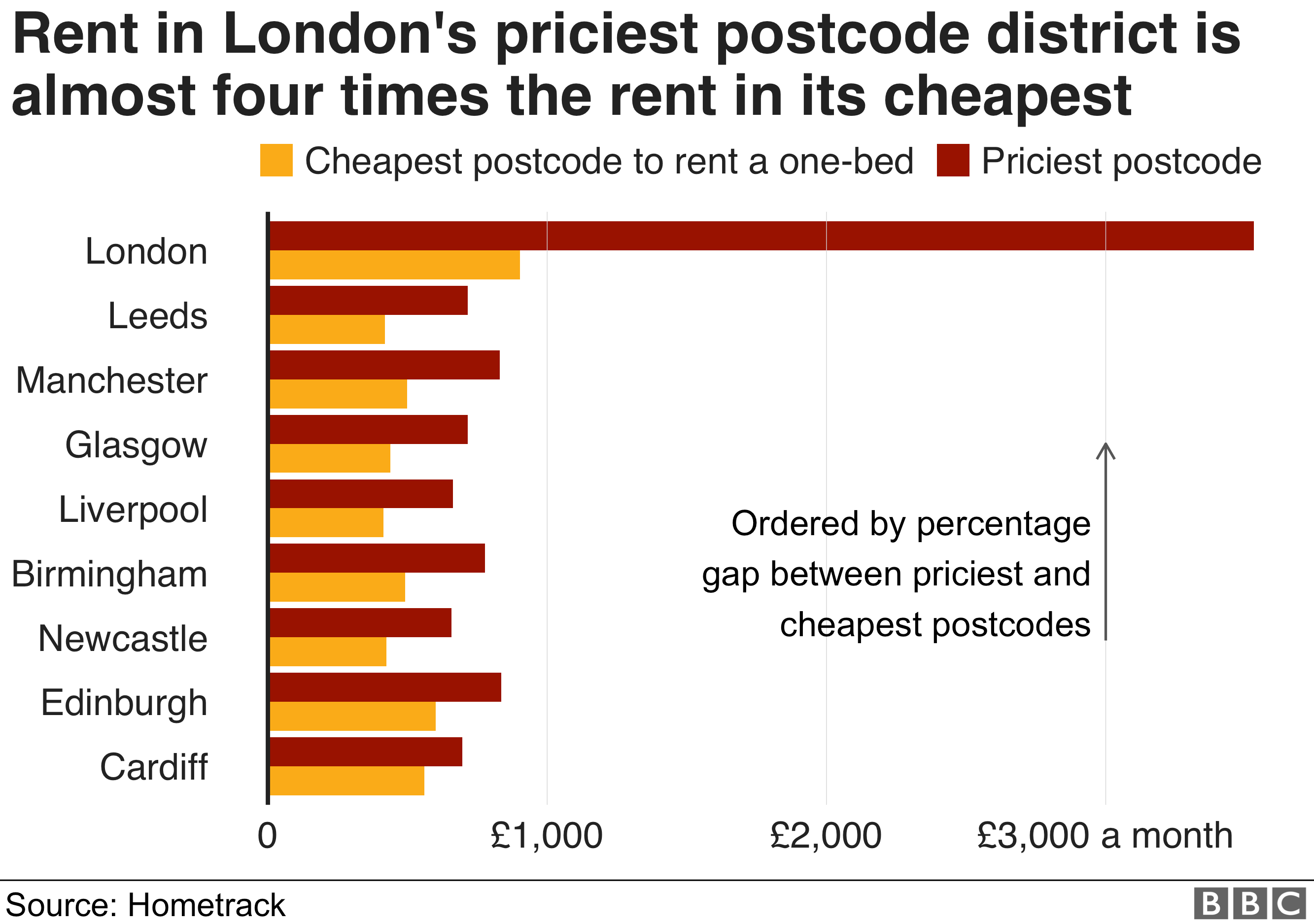

The cost of renting in the UK in seven charts BBC News

The 7 Most Affordable San Francisco Suburbs for Renters in 2024. 1.25.2024 Apartment Hunting.

How To Determine How Much You Should Charge for Rent

Your rent payment (including renters insurance) should be no more than 25% of your take-home pay. Here's an example: Let's say you make $56,000 per year. Your monthly take-home pay after taxes would be around $3,734. If you multiplied that take-home pay by 0.25, you'd wind up with $933.50.

How Much Rent Can I Afford Percentage SWOHM

You can calculate how much rent you can afford each month by multiplying your income by 30% and then dividing that number by 12 months. For example, if you make $50,000 annually, your total housing budget for the year would be $15,000, or $1,250 each month. However, if you live in an expensive city like San Francisco or New York, this may be.

Rents Skyrocket at Highest Rate in Almost a Decade Real Estate with

As a rule of thumb, your monthly rent shouldn't exceed 30% of your gross monthly income. This leaves 70% of your gross monthly income to cover other expenses. For example, if you make $50,000 per year and follow the "30% rule," you'd have $15,000 annually - up to $1,250 per month - to spend on rent. This leaves $2,900 per month for all.

How Much Profit Should You Make on a Rental Property? Sprint Finance

You can also look at your overall budget and your monthly income to be able to decide if the 30% rule makes sense for your needs. In most cases, if you triple your rent cost, you will get the amount of money that you need to make to easily pay the rent you have in mind. So, for $1,500 in rent, you need to make $4,500 each month in income to pay.

How Much is Too Much Rent? All About Anthem, Arizona

Most renters (84%) search online when looking for a home, so it's important to maximize your listing's exposure across multiple brands. With Zillow Rental Manager, you can advertise your rental listings across three of the top five rental networks — Zillow, Trulia and HotPads.* exposing your rental listing to over 30 million monthly users.

How Much Rent Can I Afford? RentHop

According to the 30% Rule, you would be able to spend $750 per month on rent, which would leave roughly $1,300 a month for savings and expenses (or $325 per week, or $46 per day) after taxes. Sounds great — until you start subtracting student loan payments (income-based repayment plans typically cap them at 8 to 10%) and retirement savings.

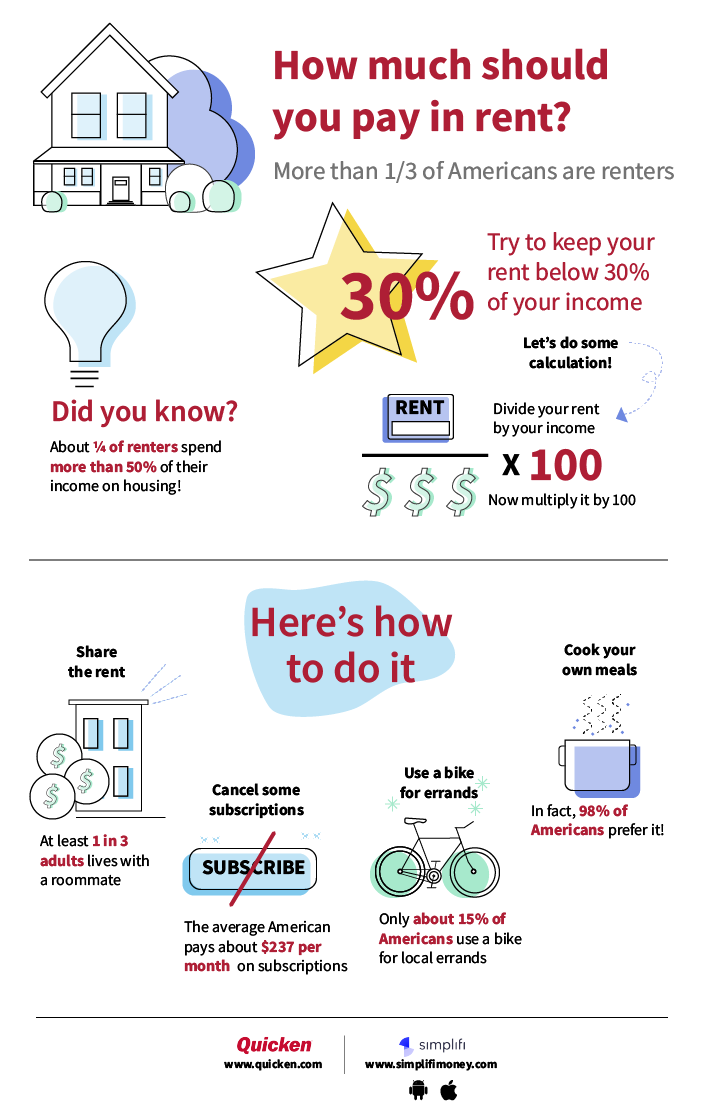

How Much Should You Spend on Rent? Quicken

Review The 1% Rule. Some landlords use the 1% rule which says that rent should be 1% of the property's value. For example, if your rental property is worth $350,000, your rental price would be $3,500. While this can be an effective general guideline, this rule doesn't factor in average rental prices, property taxes, rent control laws.

How Much Rent Can I Charge for My House?

How to Calculate How Much Rent You Can Afford. One of the most significant expenses many people have is the cost of housing. For some, this is a mortgage, but for many, this expense is paid in the form of rent.. Deciding how much you should spend on rent can be challenging, especially if you're not sure what your budget should be, how much you can afford, or if your financial future is.

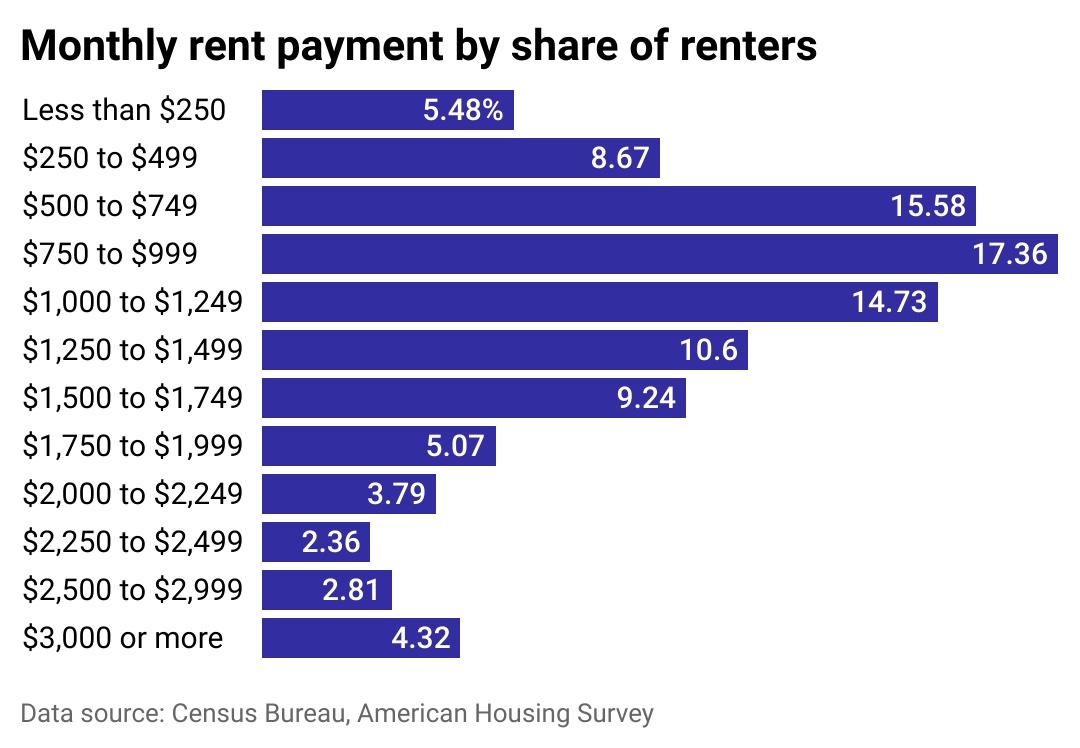

US Rental Market Outlook 5 Charts Showing the 2023 Rental Market

Renters insurance: $30. Your total monthly rental costs add up to $900. To calculate your rent-to-income ratio, divide your total rental costs by your monthly take-home income (also called your net income). Let's say your take-home income is $3,000 every month. $900 / $3,000 = 0.3 or 30%.

How Much Rent Can You Really Pay? All County Property Management

The Redfin Rental Estimate is an estimate of the fair market rental value of an individual home. Using up-to-date rental data, we look at similar properties currently listed for rent or that have recently been taken off the market. The Rental Estimate is for informational purposes only. A property's unique condition, upgrades, and location.

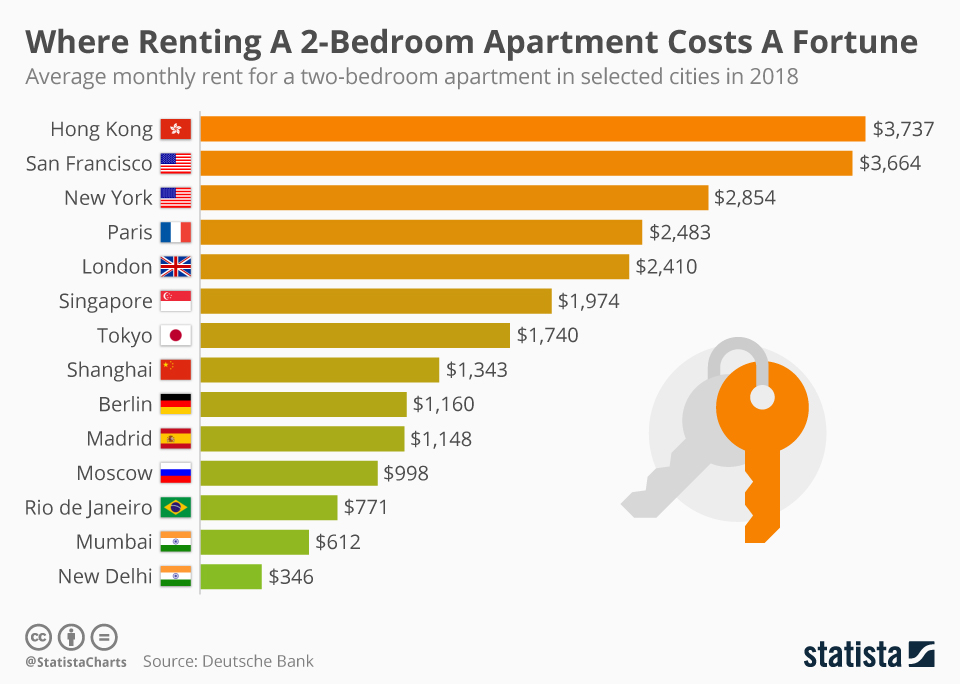

Chart Where Renting A 2Bedroom Apartment Costs A Fortune Statista

The rent-to-income ratio is a simple math formula to measure a renter's ability to pay rent.You calculate by dividing rent by the renter's income: rent-to-income ratio = rent / renter's income. For example, if the rent is $800 per month, and the renter earns $2,500 per month, their rent to income ratio is 800 / 2500 = 0.32 which is stated in percentage as 0.32 × 100 = 32%

How Much Rent Should I Ask for My Rental Home?

Rent Affordability Calculator. This calculator shows rentals that fit your budget. Savings, debt, and other expenses could impact the amount you want to spend on rent each month. Input your net (after tax) income and the calculator will display rentals up to 40% of your estimated gross income. Property managers typically use gross income to.

How Much Is Rent Allowed to Increase (And How Often)?

It depends. One popular guideline is the 30% rent rule, which says to spend around 30% of your gross income on rent. So if you earn $3,200 per month before taxes, you could spend about $960 per.

- Sony Sound Forge 9 0

- Can A Blow To The Back Cause Kidney Damage

- Equipos De Préstamo Pokémon Escarlata Vgc

- Cuantas Preguntas Tiene El Examen De Conducir A1

- Donde Comer Marisco En Galicia Barato

- Zapatos De Vestir Comodos Mujer

- Recogida De Muebles Gratis Leganés

- El Corte Inglés Rebajas Verano 2021

- Caldera Domusa Bioclass 15 Kw

- Complejo Hotelero Sant Joan Girona