The Global Oil & Gas Industry Management, Strategy and Finance eBook Andrew Inkpen Michael H

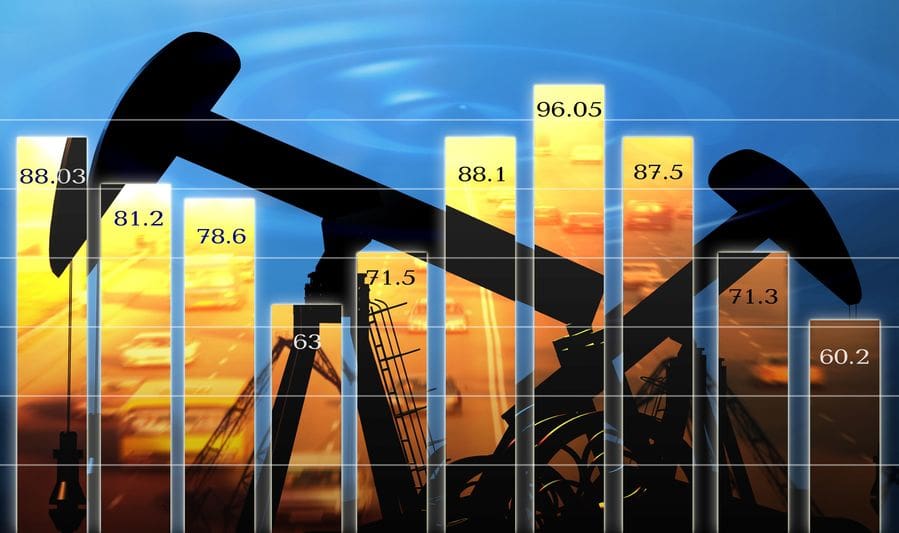

2021 oil and gas industry outlook 3 Oil prices are trapped between soft demand and rallying equity markets The Brent oil price benchmark has reflected inertia at around $45/bbl since June 2020.7 Oil's stability at this price range is reassuring, but its inability to break the upper level ($50/bbl) despite a bull run in the broader equity and

Oil & Gas Project Finance Training Course CCC Training

Key findings for third-quarter 2023 (3Q23) The Brent crude oil daily average price was 12% lower in 3Q23 than in 3Q22 and averaged $86 per barrel. The Henry Hub daily average price was 67% lower over the same period and averaged $2.66 per million British thermal units. For the 142 energy companies in our study, combined petroleum liquids.

Infographic The Biggest Oil and Gas Companies in the World Oil and gas, Big oil, Finance

Yahoo Finance's Oil & Gas Integrated performance dashboard help you filter, search & examine stock performance across the Oil & Gas Integrated industry at large.

Infographic Revenue Of The World's Largest Oil And Gas Companies In 2018 Oil (General) Oil

5:34. A group of US regional banks is ratcheting up lending to oil, gas and coal clients, grabbing market share as bigger European rivals back away. The list of banks includes Citizens Financial.

Oil & Gas Assets Tiger Group

A five-year forecast predicts that the oil and gas industry will grow moderately, with an average industry growth rate of around 2-3%. However, this will largely depend on various factors.

Worldwide Oil and Gas Industry to 2031 Identify Growth Segments for Investment

Royalty rates will rise from 12.5 per cent to 16.67 per cent, in line with a change first mandated by the Inflation Reduction Act, Biden's landmark climate law. Minimum bond requirements, used.

Top 10 Largest Oil And Gas Companies By Revenue (1990 2020) YouTube

The oil and gas industry underpins many national economies through: • Its supply of energy to industry and the domestic end consumer. • The export and import of raw materials, and derivative manufactured and refined products.. finance and spread the cost (and risk) amongst participants..

Investing in Oil The Pros and Cons

Key findings for third-quarter 2023. The Brent crude oil daily average price was 12% lower in 3Q23 than in 3Q22 and averaged $86 per barrel. The Henry Hub daily average price was 67% lower over the same period and averaged $2.66 per million British thermal units. For the 142 energy companies in our study, combined petroleum liquids production.

What to Consider When Making an Oil and Gas Investment

European law firm Fieldfisher has published the latest version of its guide, "Financing upstream oil and gas". With funding of hydrocarbons exploration and development under the ESG spotlight, the firm's oil and gas experts outline the financing options for E&P companies and how to access them. The energy transition is having a profound impact.

Infrastructure Project Finance (Oil & Gas) FBNQuest

Calculate and Discount After-Tax Cash Flows. Simply subtract the expenses from the revenue each year and then multiply by (1 - Tax Rate) to calculate the after-tax cash flows. Then, you add up and discount everything based on the standard 10% discount rate used in the Oil & Gas industry (no WACC or Cost of Equity here). 5.

Oil and Gas Business Financing Options Nav

Petrobras (PBR) leads global oil and gas investment surge, doubling investments in 2023 to $21.4 billion. Strong project returns fuel production growth and solidify PBR's position in the industry.

Finance Industry Spotlight Oil & Gas

Editor's Note: The capital markets supporting the oil and gas industry have been reshaped and realigned in recent years. But in some respects, the more things change, the more they stay the same. With higher commodity prices and renewed borrowing base redeterminations, operators are evaluating all types of opportunities as they balance investment activity with generating returns and.

Taking a Look at the Future of Oil and Gas Industry StrategyDriven

2022 oil and gas industry outlook Oil and gas companies build momentum as they look to reinvent themselves By now, close to 50% of the world's population has received at least one dose of the COVID-19 vaccine.1 Corporates are finalizing their return-to-office hybrid plans. Global GDP is expected to recover fully by the end of 2021.2 Oil.

2023 Oil and gas industry outlook EY US

Approximately 70% of respondents expect oil prices to remain above $60 per barrel through 2024. That is significantly higher than reported in last year's survey, in which the majority of investors projected an oil price between $40 and $60 per barrel. Notably, investors are just as optimistic about natural gas; 85% agree that it will play a.

The Benefits of Investing in the Oil and Gas Industry OILMAN Magazine

Healthy balance sheets create opportunities for oil and gas. By practicing capital discipline and focusing on cash flow generation and payout, the global upstream industry is projected to generate its highest-ever free cash flows of $1.4 trillion by the end of 2022 (at an assumed annual Brent oil price of $106 per barrel).

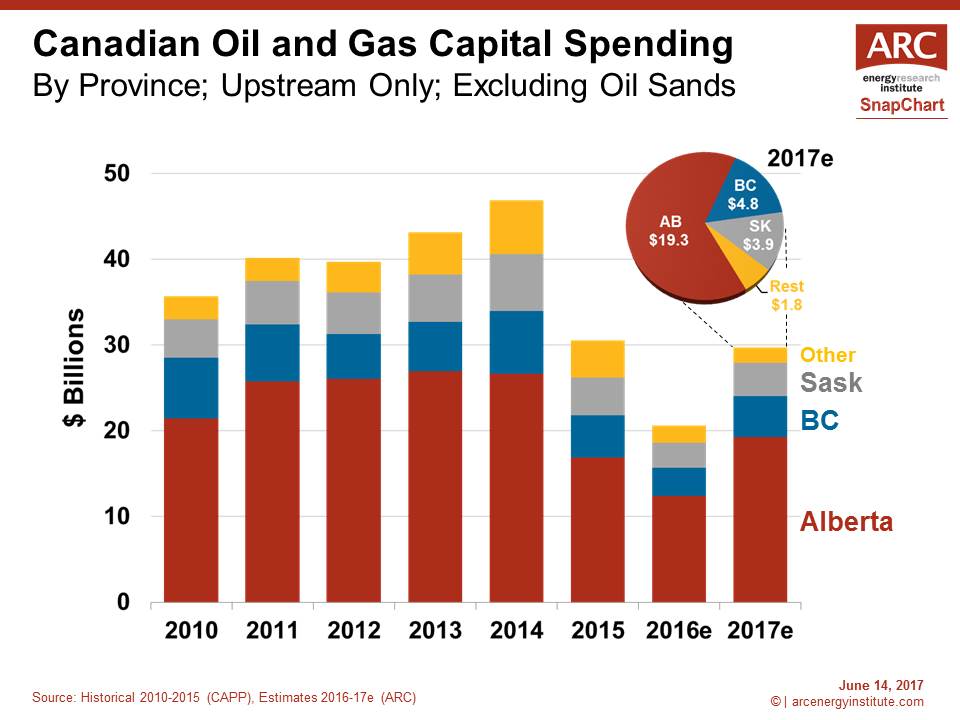

Oil And Gas Industry Oil And Gas Industry Capital Spending

Extensive coverage of the global oil and gas industry. The latest news from oil and gas companies and analysis of oil prices and production, including fracking, drilling and refining.

- 350 Square Feet In Meters

- Qualcomm Atheros Ar9485wb Eg Wireless Network Adapter Windows 10

- Caldera Saunier Duval Themafast Condens 30 Termostato Inalambrico

- Parrillada De Verduras De Temporada Madrid

- Dias Festivos Que Abren Las Tiendas

- Preguntas Sobre La Identidad Sexual

- Ciudad De La Navidad Reseñas

- Fast Casual Dining Industry Analysis

- Pantalon Gris De Vestir Mujer

- Preguntas Para Conocer Mejor A Tu Mejor Amigo