Capital Gains vs. Ordinary The Differences + 3 Tax Planning

Guernsey includes all the islands in the Bailiwick except Sark for income tax purposes. Income tax in Guernsey is charged at a flat rate of 20%. The personal allowance in Guernsey for 2023 is £13,025 per person. Guernsey also provides multiple tax caps for individuals, the details of which are listed below: There is no Capital Gains Tax.

Capital Gains Full Report Tax Policy Center

The personal income tax rate is 20% for all residents. Unlike the UK, there are no higher rate bands, capital gains tax or inheritance tax. Facebook Twitter Linked In. There is a 0% standard rate of corporate tax in Jersey. The exceptions are:. Jersey is the largest of the Channel Islands and boasts 15 miles of beautiful sandy beaches and.

Capital Gains Tax What It Is & How It Works (2023) Reverse Sales Tax

Jersey does not have inheritance, wealth, corporate or capital gains tax. Jersey's tax system has been criticised as allowing tax avoidance. As such, the country has been labelled by some as a 'tax haven', though this label is contested.. Low-value consignment relief provided the mechanism for VAT-free imports from the Channel Islands to the.

does florida have capital gains tax on real estate Commodity Column

Goods and services tax in Jersey is low, broad and simple. The rate is 5% with only a few exemptions. The standard rate of corporate income tax is 0% with exceptions for financial service companies (10% tax rate), utility companies (20% tax rate) and large corporate retailers (varies depending on the profits, maximum 20%).

Capital Gains Tax YouTube

Guernsey, Jersey, and Sark have no capital gains, inheritance, or wealth tax. There is also a low personal income tax rate, with the highest rate currently at 20%; Political stability: The Channel Islands have a stable political environment and a well-developed legal system. This provides a secure and predictable environment for investors;

.jpg&imagecache=true)

Quietschen Nachsatz sicherlich jersey channel islands Geschreddert

All Jersey property income will be subject to tax at 20%. For other income, the first 1,250,000 pounds sterling (GBP) is subject to tax at 20% and the balance at 1%. Contacts. News. Print. Search. Detailed description of taxes on individual income in Jersey, Channel Islands.

Capital Gains Tax explained

Overview. The Channel Islands, located in the English Channel, are constitutionally separate from the United Kingdom and France and, to all intents and purposes, are self-governing. Jersey, a British Crown dependency, is the largest of the Channel Islands. It is divided into 12 parishes, with Saint Helier as the capital.

Map of Jersey (United Kingdom). Jersey channel islands, Channel

Under the German Occupation of the Channel Islands, the income tax was raised to 20%. It remains at 20% and the island still does not have an inheritance, wealth, or capital gains tax.

How to Calculate Capital Gains Tax on Real Estate Investment Property

So, if a home in St. Martin is set at 10,000 quarters, the amount owed would be £128 (US$168). Jersey also charges a stamp duty. The amount of the transfer tax depends on the value of the.

The Perfect Weekend in Jersey Channel Island Itinerary! The Wandering

Deputy Prime Minister and Minister of Finance Chrystia Freeland waits for the start of a TV interview after tabling the federal budget on Parliament Hill in Ottawa, on Tuesday, April 16, 2024.

Jersey Channel islands Definitive guide for Travellers Odyssey

How to navigate the capital gains tax changes The new rules affect individuals realizing a profit of more than $250,000 on the sale of any asset, including a cottage, investment property or a.

NOUNS Capital Gains Tax OurMartech

Non-resident companies are taxable on Jersey real estate income. Companies are liable to income tax at a rate of 0%, 10%, or 20% on taxable income. The general rate applicable is 0%; the 10% and 20% rates apply to certain companies/income streams as explained in this section. The tax rate applies to the company as a whole, the only exception.

Capital Gains Tax How it's calculated Marshall Tully, Mortgage Agent

The rates we may apply are 25%, 30% or 35% depending on the tax outstanding; Exemptions from Jersey income tax. You will be exempt from income tax under the law if your income, profits or gains relate to any of the following: interest paid in respect of, or credited to, a deposit with a person registered under the Banking Business (Jersey) Law 1991

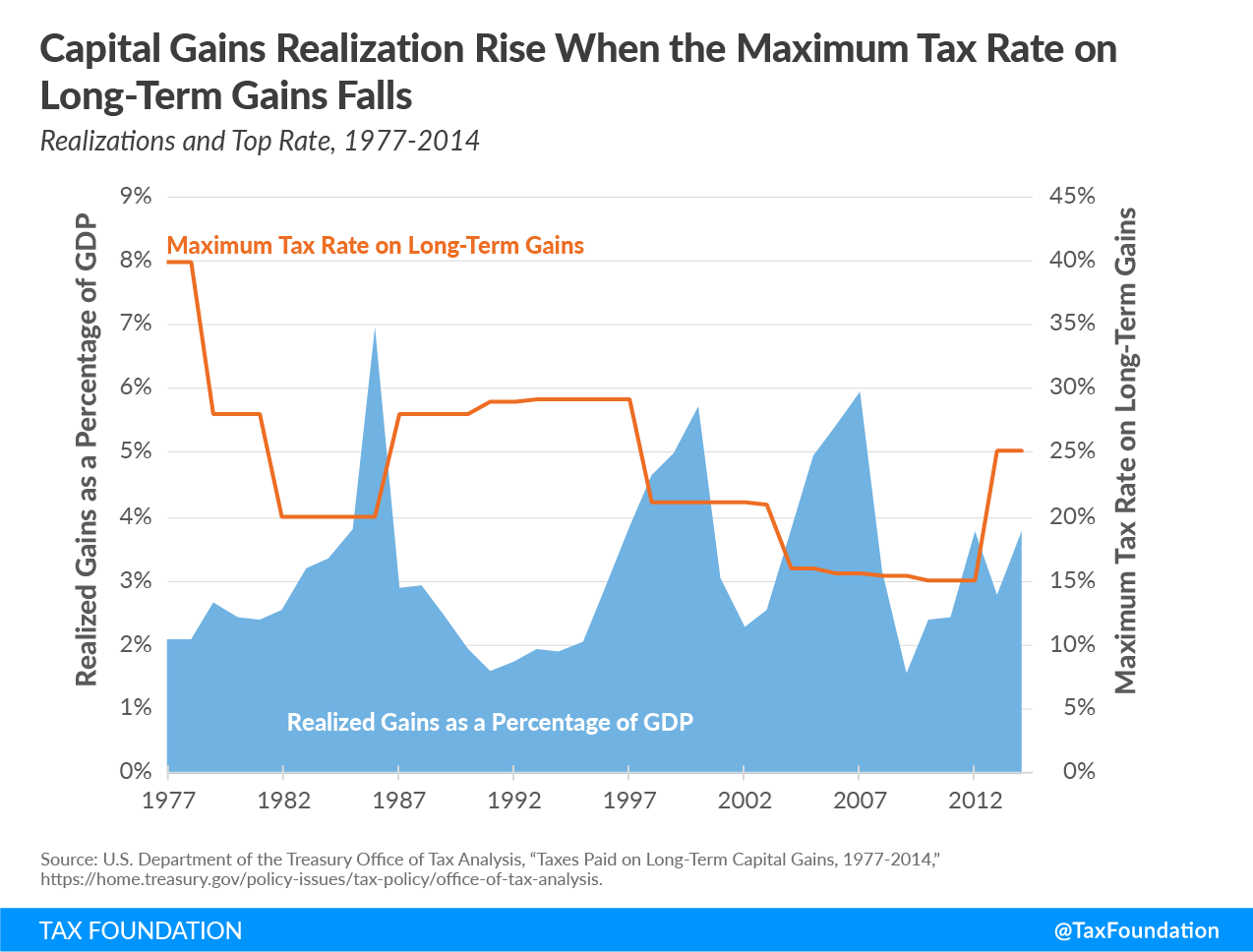

An Overview of Capital Gains Taxes Tax Foundation

Taxes in Channel Islands. Taxes in the Channel Islands are considered relatively low, and there is no VAT, capital gains or inheritance tax. This is one of the biggest attractions to expats and offshore investors. Those working in the Channel Islands can benefit from a flat income tax rate of 20 percent. As tax laws can be complex, it's best.

Capital Gain Tax on Sale of Property The Complete GUIDE

Alongside this, applicants will need to make a real estate investment, generally in excess of £1.75 million. Residents of Jersey are taxed at 20% for the first £725,000 of worldwide income, with a 1% tax charge for any income above. The island does not have inheritance, wealth, corporate, or capital gains tax, making it a popular tax haven.

How to calculate capital gain tax on shares in the UK? Eqvista

If you live in Jersey and need help upgrading call the States of Jersey web team on 440099. gov.je.. Capital allowances for tax; Childminders' self-employed tax information; Employment status: self-employed or an employee for tax; File your personal tax return;

- De Qué Está Hecho La Salchicha

- El Gato Negro Y Otros Cuentos De Horror Pdf

- Polvo Para Preparar Bebida Hidratante

- Growth Of Aviation Industry In India

- Cartelera Cine Heron City Las Rozas

- Average Cost Per Square Foot To Build A Custom Home

- Hoteles En Oviedo Con Piscina

- Cachatro Para Cubrir Maletero De Coche

- Baldur S Gate 3 Burrow Hole

- 1949 Ford Panel Truck For Sale